6 Steps To Take After A Loved One’s Life Insurance Claim

Dealing with the loss of a loved one is an emotional and challenging time. When life insurance is involved, there are additional steps to take to ensure that the claim is processed smoothly and the benefits are received. Here’s a guide to the key steps to take after filing a loved one’s life insurance in Dubai claim:

Obtain and review the policy documents:

After a loved one’s passing, the first step is to locate and review their life insurance policy documents. These documents provide vital information about the coverage, beneficiaries, and any specific conditions or requirements. Understanding the policy details, including the amount of coverage and any exclusions, will help you manage the claims process more effectively.

Contact the insurance company:

Notify the life insurance company of your loved one’s death as soon as possible. This initial contact often involves providing a copy of the death certificate and any required claim forms. Insurance companies typically have dedicated claims departments to guide you through the process. Ensure you keep a record of all communications with the insurer, including names, dates, and any reference numbers.

Submit necessary documentation:

- Death certificate: An official copy of the death certificate is required to validate the claim.

- Claim form: Complete the insurer’s claim form with accurate information.

- Proof of identity: Identification documents for the beneficiary may be required.

- Policy documents: A copy of the insurance policy may need to be provided.

Follow up on the claim status:

After submitting the claim, regularly follow up with the insurance company to track the status of the claim. Insurance companies may take several weeks or even months to process a claim, depending on the complexity and completeness of the information provided. Inquire about any additional information or steps needed to expedite the process.

Review the settlement offer:

Once the claim is approved, the insurance company will provide a settlement offer outlining the payout amount and distribution method. Review the offer carefully to ensure it aligns with the policy’s terms and conditions. If you have any questions or concerns about the settlement amount or the distribution process, contact the insurance company for clarification.

Consult a financial advisor or attorney:

Consider consulting a financial advisor or attorney, especially if the settlement involves significant sums or complex financial matters. An advisor can provide guidance on managing the insurance payout, including investment options, tax implications, and financial planning. An attorney can help with legal matters, such as addressing any disputes or ensuring that the benefits are distributed according to the policy’s terms and applicable laws.

The Rise of Eco-Friendly and Sustainable Hair Salons

The Rise of Eco-Friendly and Sustainable Hair Salons  The Significance Of Knowing The Expiry Date Of Lice Removal Shampoo

The Significance Of Knowing The Expiry Date Of Lice Removal Shampoo  Bi-Fold Windows Connecting Your Indoor and Outdoor Kitchens

Bi-Fold Windows Connecting Your Indoor and Outdoor Kitchens  Finding the Best Preschool for Your Child’s Unique Needs

Finding the Best Preschool for Your Child’s Unique Needs  Five Styles of Wall Art Painting to Explore

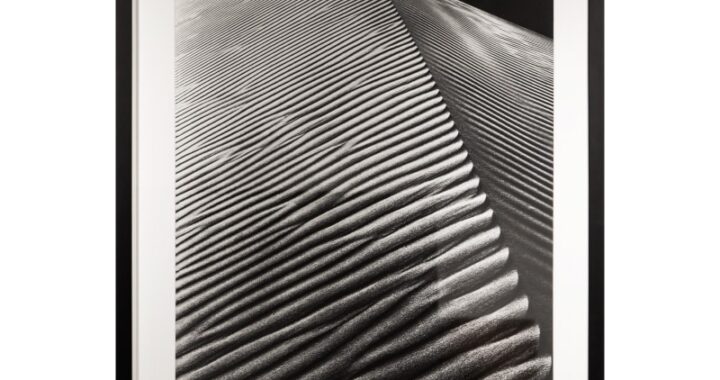

Five Styles of Wall Art Painting to Explore  Top Benefits of Using a Local Shuttle Service

Top Benefits of Using a Local Shuttle Service